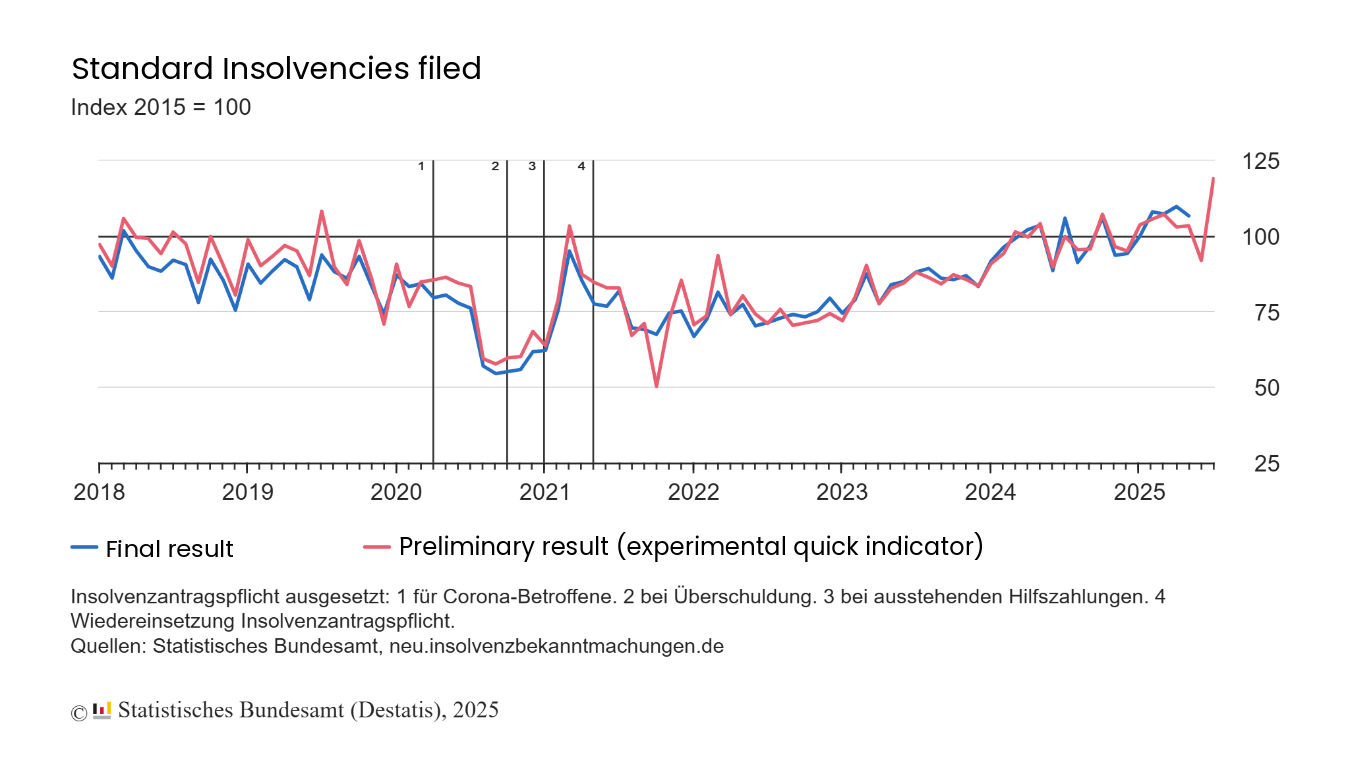

Germany experienced a significant increase in corporate insolvencies in July 2025, according to preliminary data released by the Federal Statistical Office (Destatis). The number of standard insolvency filings rose by 19.2% compared to the same month last year, marking the highest growth rate since October 2024, when insolvencies jumped by 22.9%. This alarming rise highlights ongoing economic challenges facing German businesses amid a fluctuating market environment.

Looking at corporate insolvency trends earlier in the year, local courts reported 2,036 corporate bankruptcies in May 2025, a 5.3% increase from May 2024. Although the number of insolvencies increased, the creditors’ claims from these bankruptcies slightly decreased from €3.4 billion in May 2024 to around €3.2 billion in May 2025, indicating a marginal reduction in the overall financial exposure from company failures.

Sector-wise, insolvency rates varied considerably. In May 2025, Germany recorded an average of 5.9 corporate bankruptcies per 10,000 companies. The transport and warehousing sector was the hardest hit, registering 10.9 insolvencies per 10,000 firms. The construction sector followed with 9.4 insolvencies per 10,000 companies, and the hospitality industry experienced 9.0 insolvencies per 10,000 companies. These figures reflect sector-specific vulnerabilities, possibly due to supply chain disruptions, labor shortages, or shifts in consumer demand.

In addition to corporate insolvencies, consumer bankruptcies also saw a marked increase. May 2025 recorded 6,605 consumer insolvencies, which represents a 16.1% rise compared to the same month last year. This surge in personal bankruptcies signals growing financial distress among households, potentially exacerbated by inflationary pressures and rising living costs.

It is important to note that the insolvency statistics are based on court decisions rather than the actual filing dates. Insolvency applications are typically recorded in the data approximately three months after the original filing date. Therefore, the July 2025 figures may reflect financial distress experienced by companies as early as April or May

The sharp uptick in both corporate and consumer insolvencies underscores the economic pressures in Germany as businesses and individuals grapple with ongoing challenges. Analysts will be closely monitoring these trends to assess the broader impact on the German economy and to advise policymakers on potential interventions to support distressed companies and consumers.

For businesses operating in vulnerable sectors, these statistics serve as a crucial warning to review financial strategies and risk management approaches amid uncertain market conditions. The rise in insolvencies may also prompt lenders and investors to exercise greater caution in their dealings with high-risk industries.

As Germany navigates this period of financial instability, stakeholders will need to balance immediate crisis management with long-term economic resilience to mitigate further insolvency risks in the coming months.